Have you helped your company buy something with your own money and now need to claim it? Don’t worry, claiming back expenses can be easy if you’re prepared, especially with Malaysia’s new e-invoice system. Follow these tips to ensure a smooth process and hassle-free claims.

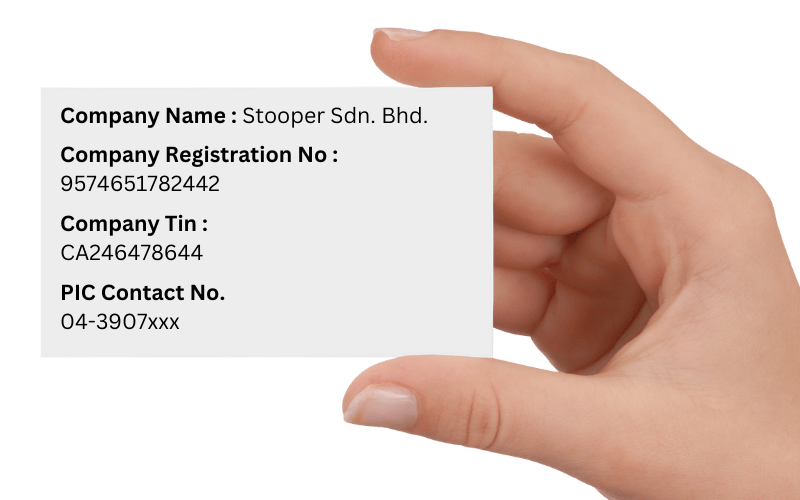

1. Get an E-Invoice Card from Your Company

To simplify the process, ask your company for an e-invoice card. This card can be in various formats:

- Physical Card: Carry it in your wallet for quick access.

- Digital Formats: Save it as a JPG photo, PDF, or screenshot on your mobile phone so you can show it to sellers anytime.

The card should include:

- Company Name: As registered with SSM.

- Company New Registration number

- Company TIN (Tax Identification Number): This is essential for creating valid e-invoices.

- Contact Info: A finance team email or phone number for any clarifications.

Having this ready saves you time explaining to the seller what’s needed.

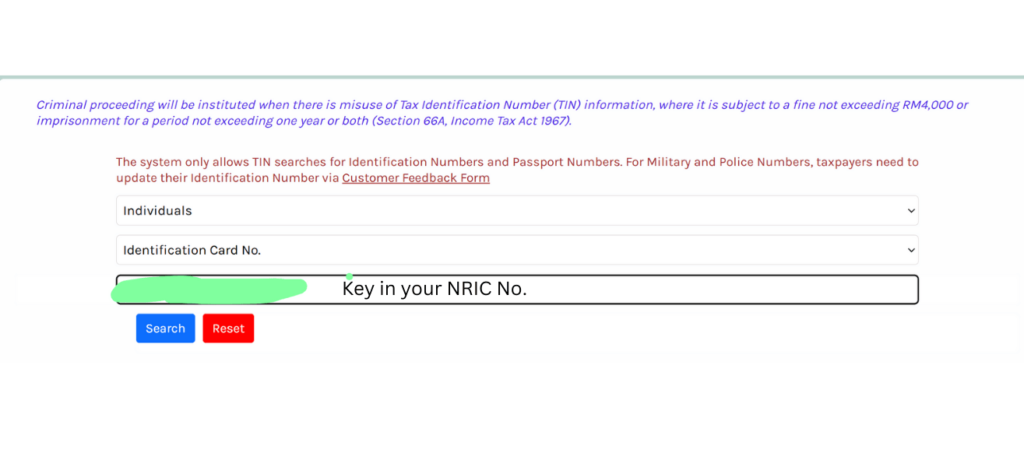

2. Prepare Your Own TIN Number

If your company requires you to be listed in the invoice as the buyer, you might need to provide your personal TIN number.

- What is a TIN Number?

A Tax Identification Number (TIN) is a unique number assigned by the IRBM for tax purposes.

- How to Check Your TIN?

You can find or register for your TIN on the MyInvois Portal or contact the IRBM.

- Why is It Needed?

Some companies require this for accurate tax reporting and to match the transaction with your claim. It’s also mandatory in some cases to validate the e-invoice.

Check out here : Malaysia Tin number Guidelines

3. Inform the Seller You Need an E-Invoice

Before making a purchase, let the seller know that you require an e-invoice. Share the information from your e-invoice card and ensure the following:

- Digital Copy: Ask for XML or JSON format. If unavailable, a validated PDF with a QR code is acceptable.

- Complete Details: Verify that the invoice includes your company name, TIN, and the item details.

4. Is the QR Code Necessary?

Yes, the QR code is an important feature in a seller’s e-invoice. It allows instant validation of the invoice through the IRBM system. Always check for:

- A visible QR code on the invoice.

- The QR code links to the validated invoice details when scanned.

If there’s no QR code, double-check with the seller to ensure the invoice is validated through the IRBM system.

5. What If the Shop Can’t Provide an E-Invoice?

Not all shops, especially traditional or smaller ones, are equipped to issue e-invoices yet. Here’s what to do:

- Request a Standard Receipt: Ensure it includes the shop’s name, address, date, and amount.

- Add Your Company Details: Write down your company name and TIN on the receipt.

- Explain to Your Finance Team: Submit the receipt with a note explaining why an e-invoice wasn’t provided.

Your company may still accept this with additional supporting documents.

6. Keep Everything Organised

After completing the purchase:

- Save all e-invoices and receipts digitally in one folder on your phone or computer.

- Label them clearly with the purchase date and purpose (e.g., “Lunch Meeting_28Dec2024”).

- Keep a backup of physical receipts in case the company requests originals.

7. Submit Your Claim Promptly

When filing your claim:

- Attach the e-invoice or receipt.

- Include a brief explanation of the expense.

- Provide any additional documents, like pre-approvals or approvals via email.

Checklist: What to Prepare

| Item | Details |

|---|---|

| E-Invoice Card | Physical or digital format (JPG, PDF) with company details and TIN. |

| Your TIN Number | Check or register on the MyInvois Portal if required by your company. |

| Supplier Details | Name, address, and business registration number on the receipt/invoice. |

| Purchase Details | Date, amount, item/service description. |

| Proof of Payment | Validated e-invoice with QR code or standard receipt with justification. |

| Approval Documents | Pre-approval or email confirmation if necessary. |

By being prepared and knowing how to handle situations where e-invoices aren’t provided, you can ensure your claims process is smooth and compliant with Malaysia’s e-invoice system.

Got any questions or tips to share? Let us know below!

Looking for more guidelines : LHDN E-Invoice Guidelines

For our business insight : Stooper’s business insight

MYR 1 →

MYR 1 → USD: 0.2358

USD: 0.2358  SGD: 0.3036

SGD: 0.3036  EUR: 0.2083

EUR: 0.2083  THB: 7.6927

THB: 7.6927  KRW: 323.1171

KRW: 323.1171  CNY: 1.6972

CNY: 1.6972  JPY: 33.6755

JPY: 33.6755