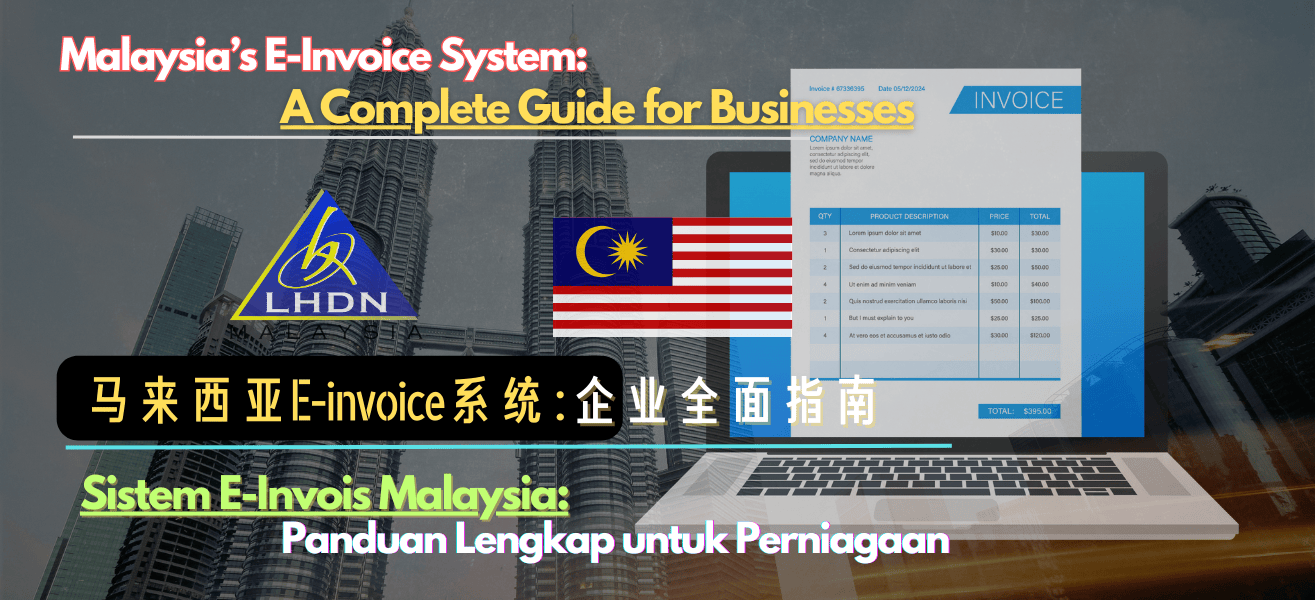

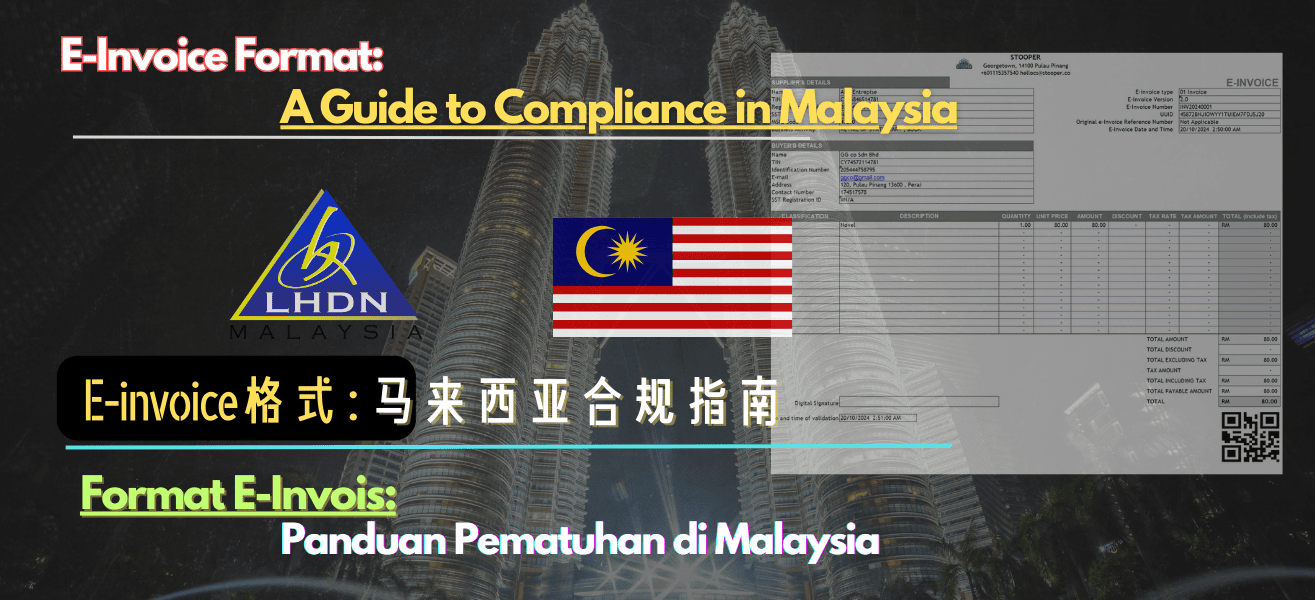

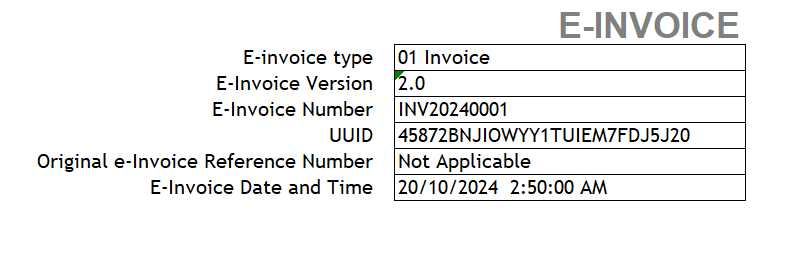

Malaysia has recently introduced mandatory e-invoicing requirements as part of its efforts to streamline tax compliance and modernize financial transactions. Under the new rules set by the Inland Revenue Board of Malaysia (IRBM), e-invoices must adhere to a specific format that includes essential components like a unique identifier and a QR Code.

Unique Identifier: What It May Look Like

Definition: The unique identifier is a key element of the e-invoice, serving as a reference number to ensure each invoice is distinguishable and traceable within the tax system. While it is sometimes referred to as a UUID (Universally Unique Identifier), the exact format and structure may vary based on the final implementation guidelines.

Key Characteristics:

- Length: It is often stated as 26 or 36 characters; however, this may depend on system-specific requirements.

- Character Set: Typically consists of Latin alphanumeric characters (A-Z, a-z, 0-9) and may include hyphens.

- Purpose: To uniquely identify each e-invoice, ensuring authenticity and preventing duplication.

- Issuing Authority: Generated through the IRBM’s MyInvois Portal or related systems.

When Does the Unique Identifier Appear?

- It is generated during the e-invoice validation process.

- The identifier is included in the invoice header and encoded within the QR code for verification.

QR Code: Enhancing Accessibility and Validation

Definition: The QR code is a machine-readable, two-dimensional barcode that contains critical invoice details. It simplifies access to invoice information and supports tax compliance.

Key Characteristics:

Encodes Essential Data:

- Invoice number and date.

- Seller and buyer details.

- Taxable amount, tax rate, and total tax.

- The unique identifier (if applicable).

Placement: Prominently displayed on the e-invoice document.

Functionality: Can be scanned using QR code readers or smartphone cameras for quick access.

When Does the QR Code Appear?

- The QR code is generated alongside the unique identifier during the validation process.

- It serves as a verification tool for buyers, tax authorities, and other stakeholders.

Why is the QR Code Important?

- Provides instant access to invoice details.

- Automates data retrieval and reduces manual errors.

- Facilitates tax reconciliation by allowing authorities to cross-check invoice data in real-time.

How the E-Invoice Format Works

A standard Malaysian e-invoice format includes the following sections:

Invoice Header:

- Invoice number.

- Invoice date.

- Unique identifier (format may vary).

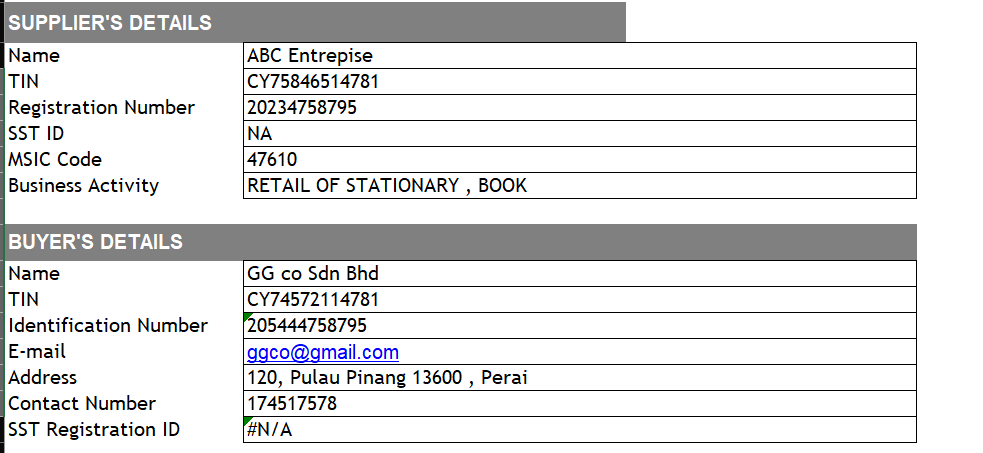

Seller and Buyer Details:

- Names and addresses.

- Taxpayer Identification Numbers (TIN).

Itemized Details:

- Description of goods or services.

- Quantities, unit prices, and total amounts.

Tax Details:

- Taxable amount.

- Tax rate and total tax amount.

QR Code:

- Encodes the above details for verification and compliance purposes.

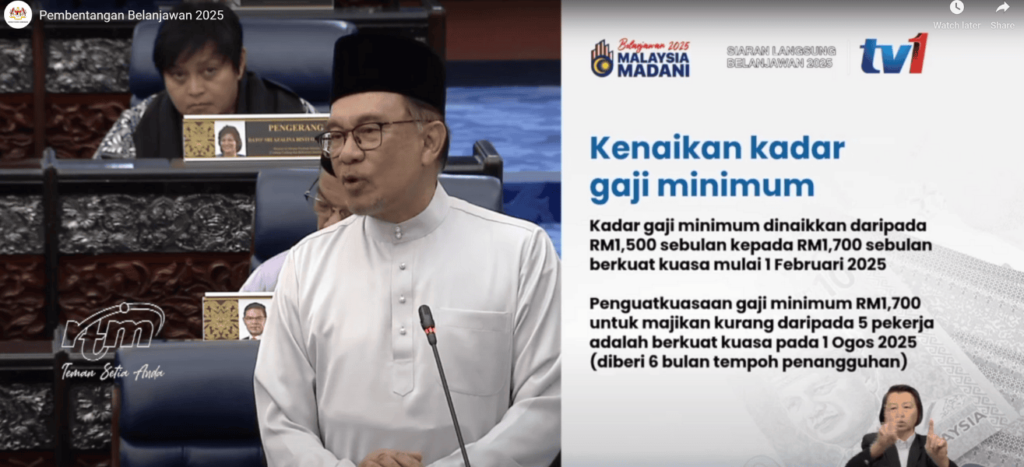

Compliance Timeline for Malaysian Businesses

The rollout of e-invoicing in Malaysia is phased based on annual turnover:

- 1 August 2024: Taxpayers with an annual turnover exceeding RM100 million.

- 1 January 2025: Taxpayers with an annual turnover between RM25 million and RM100 million.

- 1 July 2025: All remaining taxpayers.

Malaysia’s e-invoice format, with its unique identifier and QR code, represents a significant step toward enhancing tax compliance and financial transparency. While the exact format of the unique identifier may vary, its role in ensuring invoice authenticity is crucial. Businesses must ensure their invoicing systems are updated to accommodate these elements and meet regulatory requirements. By adopting e-invoicing, companies can improve operational efficiency and align with modern tax administration practices.

For more details, refer to the official IRBM e-Invoice Guidelines.

For more blog check here : Stooper

MYR 1 →

MYR 1 → USD: 0.2358

USD: 0.2358  SGD: 0.3036

SGD: 0.3036  EUR: 0.2083

EUR: 0.2083  THB: 7.6927

THB: 7.6927  KRW: 323.1171

KRW: 323.1171  CNY: 1.6972

CNY: 1.6972  JPY: 33.6755

JPY: 33.6755