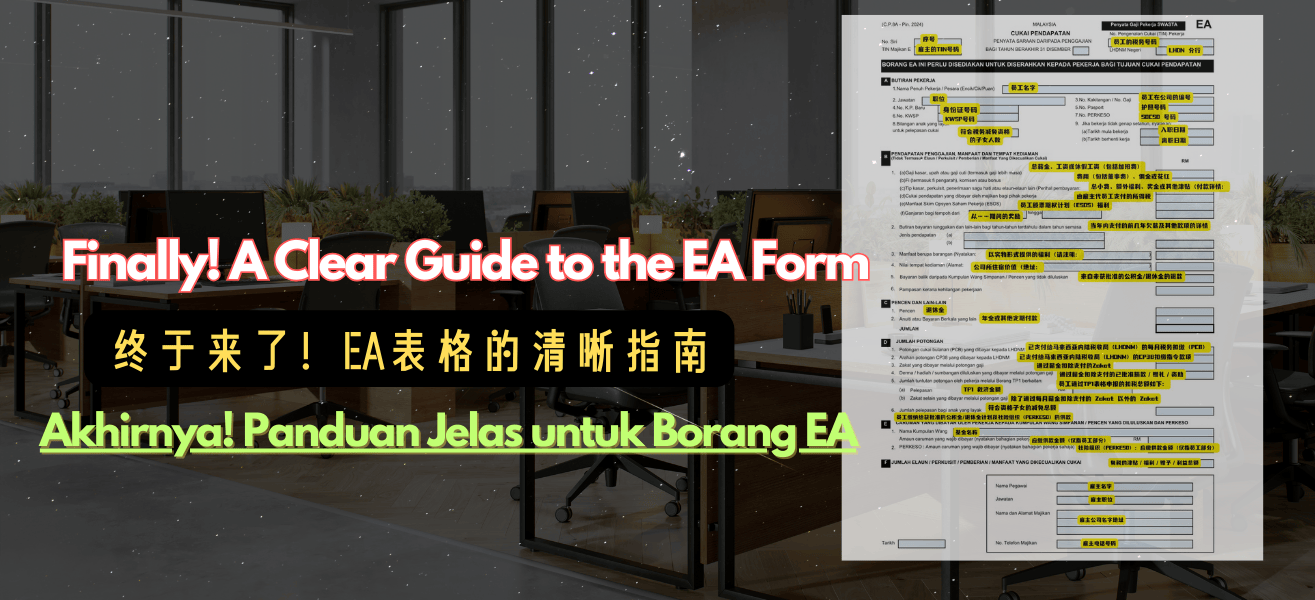

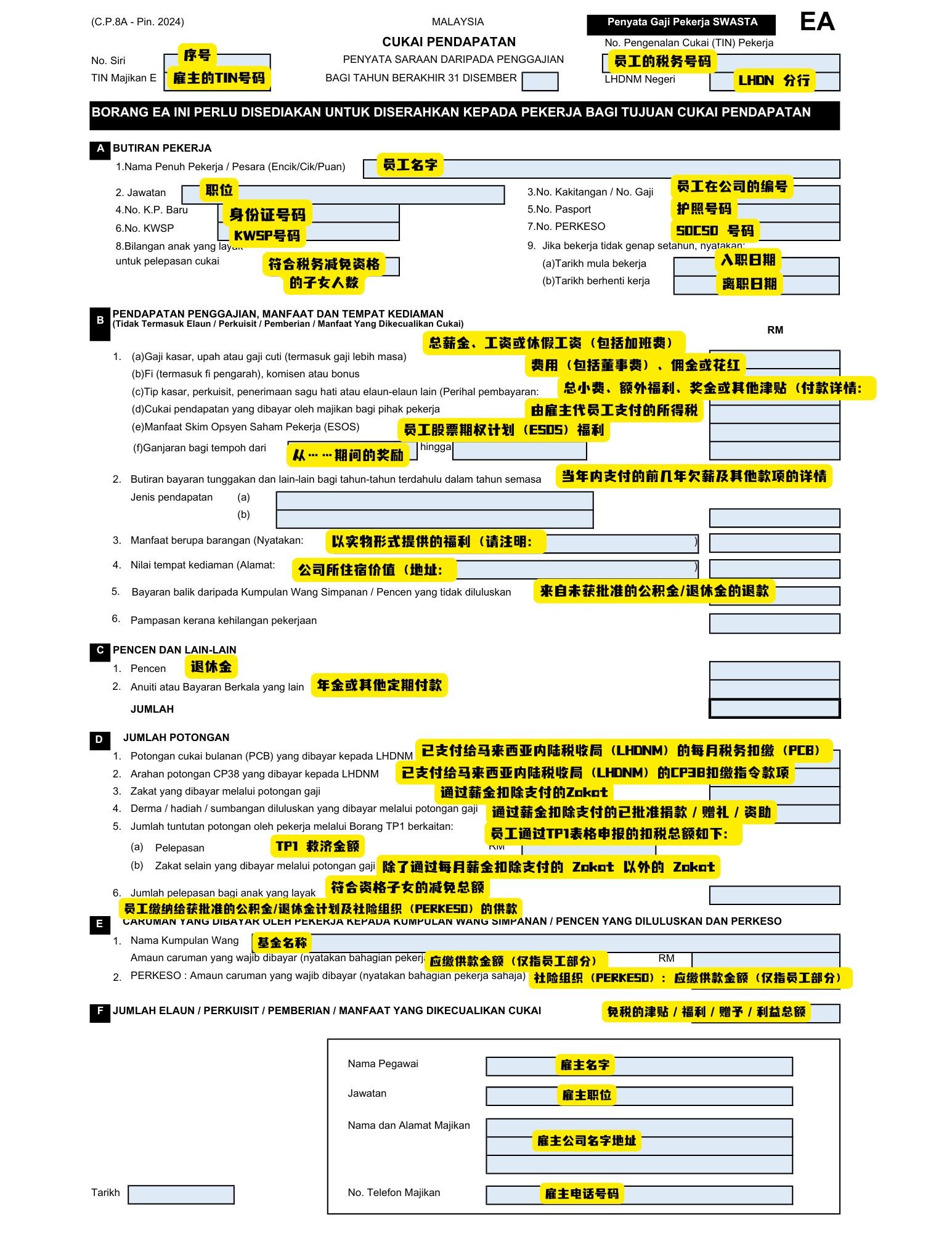

🧾 Apa Itu Borang EA?

Borang EA ialah dokumen rasmi yang dikeluarkan oleh majikan di Malaysia kepada pekerja, merangkumi jumlah pendapatan, potongan, dan faedah untuk tahun tertentu. Ia juga dikenali sebagai CP8A dan wajib untuk pengisian cukai pendapatan individu.

Anda perlukan borang ini untuk lengkapkan e-Filing melalui sistem MyTax LHDN, dan juga untuk semak sama ada potongan PCB (Potongan Cukai Bulanan) setiap bulan adalah betul.

📌 Kenapa Borang EA Penting?

Langkah pertama untuk isi cukai pendapatan dengan betul adalah faham Borang EA anda. Ini sebab ia penting:

- Majikan wajib keluarkan Borang EA sebelum 28 Februari setiap tahun.

- Ia membantu anda tahu sama ada anda terlebih bayar atau terkurang bayar cukai.

- Jika majikan anda memuat naik CP8D, maklumat dalam Borang EA akan diisi secara automatik dalam e-Filing anda.

- Tak terima Borang EA? Majikan anda boleh didenda sehingga RM20,000.

🔍 Cara Faham Setiap Bahagian dalam Borang EA

A. Butiran Pekerja

Termasuk nama penuh anda, nombor IC/pasport, nombor SOCSO, nombor KWSP (EPF), dan tempoh bekerja.

B. Pendapatan daripada Pekerjaan

Mengandungi butiran gaji asas, bonus, elaun, komisen, tunggakan gaji, manfaat berupa barangan (BIK), dan nilai penginapan (VOLA).

C. Pencen & Lain-lain

Hanya terpakai jika anda menerima pencen atau anuiti.

D. Potongan

Menunjukkan PCB bulanan anda, arahan CP38, zakat, derma, dan pelepasan cukai yang dimohon melalui borang TP1.

E. Caruman Berkanun

Meliputi potongan KWSP dan PERKESO untuk bahagian pekerja sahaja.

F. Faedah Dikecualikan Cukai

Senaraikan faedah yang dikecualikan cukai seperti elaun petrol, tempat letak kereta, atau bantuan penjagaan anak (sehingga RM6,000).

💻 Hantar Borang EA melalui e-Filing & e-PCB

Untuk isi cukai melalui e-Filing, log masuk ke: MyTax portal dan kemudian:

- Pilih tahun Borang EA anda (contoh: 2024 untuk Tahun Taksiran 2025).

- Padankan setiap ruangan dalam Borang EA dengan tempat yang betul:

- Pendapatan B(a)–(e) = “Pendapatan berkanun daripada pekerjaan”

- D(1) = “PCB Dibayar”

- D(3) = “Zakat”

- E(1) = “Caruman KWSP (EPF)”

- E(2) = “PERKESO & SIP (EIS)”

Sistem e-PCB ialah sistem yang digunakan oleh majikan anda setiap bulan untuk kiraan cukai. Borang EA pula ialah ringkasan akhir tahunan. Jika ada sebarang perbezaan, anda mesti betulkannya semasa e-Filing.

🚫 Kesilapan Biasa yang Perlu Dielakkan

- Hanya isi gaji asas tanpa tambah elaun dan bonus.

- Tersilap tuntut caruman KWSP majikan (tidak dibenarkan).

- Tertinggal nilai VOLA atau BIK — ini adalah pendapatan yang kena cukai!

- Kira PCB dua kali — hanya perlu isi sekali sahaja.

- Terlupa isi potongan CP38 (jika ada).

💡 Tip untuk Maksimumkan Bayaran Balik Cukai Anda

- Semak semula jumlah PCB yang dibayar (pastikan sama dengan slip gaji).

- Isytihar perbelanjaan penjagaan anak, insurans, dan tuntutan gaya hidup.

- Potongan zakat kurangkan cukai anda secara 1:1.

- Jika anda bekerja di beberapa syarikat, gabungkan semua maklumat Borang EA sebelum hantar.

✅ Kesimpulan: Yakinlah Urus Borang EA Anda!

Sekarang anda sudah tahu cara baca, isi, dan semak Borang EA anda—musim cukai tak perlu jadi stres lagi. Panduan ini bawa anda langkah demi langkah, bantu anda isi dengan yakin—dan mungkin dapat bayaran balik juga!

Perlu senarai semak yang boleh dicetak? Atau nak kami semak draf anda sebelum hantar?

Langgan untuk lebih banyak tip cukai atau muat turun Panduan Isi Borang EA (PDF) kami hari ini!

Untuk lebih banyak panduan, tip dan insight perniagaan, lawati: Stooper’s Business Insight

MYR 1 →

MYR 1 → USD: 0.2358

USD: 0.2358  SGD: 0.3036

SGD: 0.3036  EUR: 0.2083

EUR: 0.2083  THB: 7.6927

THB: 7.6927  KRW: 323.1171

KRW: 323.1171  CNY: 1.6972

CNY: 1.6972  JPY: 33.6755

JPY: 33.6755