Malaysia is introducing e-Invoicing through the MyInvois System, aiming to modernize how businesses record and validate transactions. This guide explains e-Invoicing, self-billed invoices, and how businesses in Malaysia can comply with the new rules.

What is an Invoice?

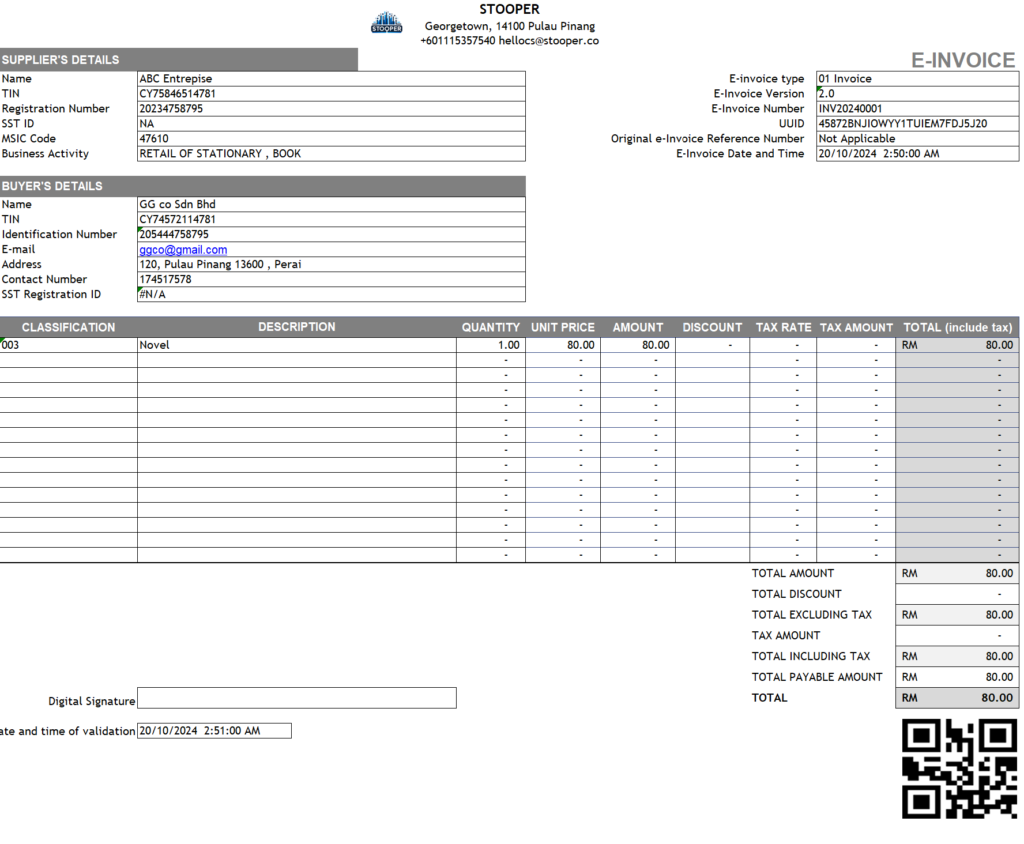

An invoice is a document issued by a seller to a buyer to list goods or services and payment details. With e-Invoicing, invoices become digital and machine-readable, in formats like XML or JSON, and are validated by the Inland Revenue Board of Malaysia (IRBM).

Types of E-Invoices

- Standard Invoice

- Definition: Issued by the seller.

- Example: A wholesaler selling office supplies to a company issues an e-Invoice listing items, quantities, and terms.

- Self-Billed Invoice

- Definition: Created by the buyer when the seller cannot issue invoices.

- Example: A tenant pays rent to a landlord who is not running a business and issues a self-billed invoice for tax compliance.

- Credit Note

- Definition: Corrects errors or adjusts overcharges without refunds.

- Example: If a retailer receives fewer items than ordered, the supplier issues a credit note to adjust the bill.

- Debit Note

- Definition: Adds charges to a previous invoice.

- Example: A logistics company charges extra storage fees by issuing a debit note.

- Refund Note

- Definition: Records the return of payments.

- Example: A store refunds a customer for a defective product and issues a refund note.

Benefits of E-Invoicing

- Compliance: Mandatory under phased implementation by IRBM.

- Accuracy: Reduces errors with structured formats.

- Transparency: Real-time validation ensures invoice legitimacy.

- Efficiency: Speeds up processes and reduces paperwork.

Self-Billed Invoices

What are they?

Self-billed invoices are issued by buyers for specific transactions, like paying rent to non-business landlords or dealing with suppliers unable to provide invoices.

When to Use Them?

- Rent payments to non-business landlords.

- Importing goods/services where the supplier doesn’t issue E-invoices.

- Transactions with rural suppliers lacking internet access.

For Importing Goods from Overseas:

When importing goods from suppliers overseas, businesses should issue a self-billed invoice if the supplier does not provide an invoice. Ensure that the customs form code and HS code are included in the e-Invoice to comply with customs and tax regulations.

Revising E-Invoices

How long can e-Invoices be revised?

E-Invoices can be canceled and replaced within 72 hours of validation by IRBM. After 72 hours, adjustments require credit notes, debit notes, or refund notes.

Example:

A business realizes an overcharge on an e-Invoice. If caught within 72 hours, they cancel the invoice and issue a corrected one. Beyond 72 hours, they use a credit note to adjust the amount.

Key Steps for Businesses

- Understand the Rules: e-Invoices are required for both local and cross-border transactions.

- Prepare Systems: Use the MyInvois portal or integrate APIs for seamless e-Invoice handling.

- Submit Timely: Consolidated invoices must be submitted within seven days after month-end. Errors should be corrected within 72 hours.

- Include Customs Form Code and HS Code for Imports: For imported goods, businesses must key in the relevant customs form code and HS code when issuing e-Invoices to ensure compliance with customs and tax regulations.

Malaysia’s e-Invoicing system simplifies tax compliance and enhances transparency. By understanding the various types of invoices, self-billing, and revision timelines, businesses can adapt to the new system with ease and stay compliant with IRBM requirements.

For more information about E-Invoice : Official Guildelines of E-Invoice on LHDN

For more blog : Stooper’s Business Talk

MYR 1 →

MYR 1 → USD: 0.2358

USD: 0.2358  SGD: 0.3036

SGD: 0.3036  EUR: 0.2083

EUR: 0.2083  THB: 7.6927

THB: 7.6927  KRW: 323.1171

KRW: 323.1171  CNY: 1.6972

CNY: 1.6972  JPY: 33.6755

JPY: 33.6755