On 16 May 2025, Paradigm REIT launched its initial public offering (IPO), offering 560 million units at RM 1.00 apiece. The offer comprises a Retail Offering of ~255 million units and an Institutional Offering of ≥ 305 million units. Subscription closes on 23 May 2025, with trading to commence on Bursa Malaysia on 10 June 2025.

Why the IPO?

- Unlock Sponsor Value

WCT Holdings’ shareholders can now participate directly in the upside of three high-quality retail assets.

- Enhance Liquidity

Listing on Bursa transforms illiquid mall ownership into tradable securities.

- Access Capital Markets

Backed by a RM 5 billion medium-term note (MTN) programme, future acquisitions can be funded efficiently without equity dilution.

- Deliver Yield & Growth

Investors gain access to stable semi-annual distributions and potential capital gains from rental uplifts and portfolio expansion.

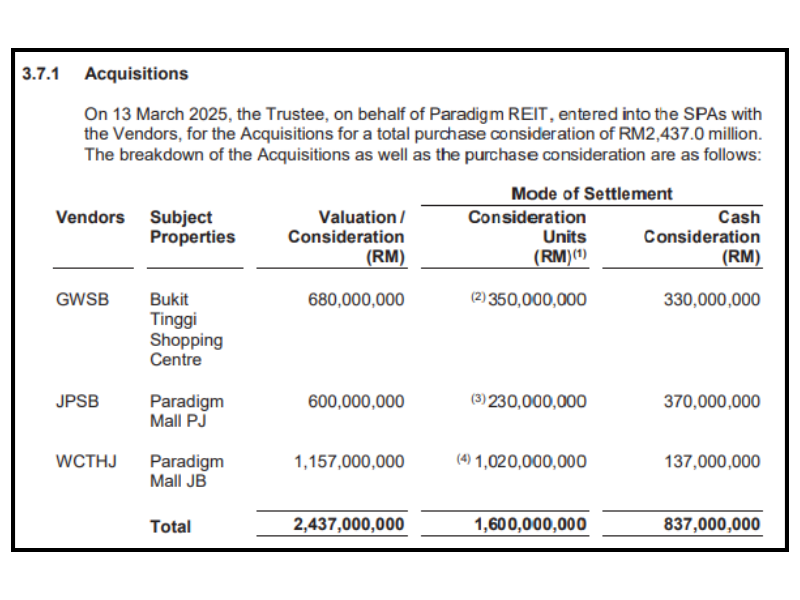

1. Portfolio Snapshot & Valuation

- Properties:

- Bukit Tinggi Shopping Centre (BTSC) – Klang, freehold

- Paradigm Mall PJ – Petaling Jaya, leasehold to 9 Feb 2111

- Paradigm Mall JB – Johor Bahru, freehold

- Appraised Value (31 Dec 2024): RM 2.437 billion.

2. Tenant Mix & Lease Structures

| Property | Anchor Tenant(s) | Lease Details | Tenant Count | Top-10 GRI Share |

|---|---|---|---|---|

| BTSC | AEON (master lease) | 6 years (24 Nov 2023–23 Nov 2029); fixed escalations: +1.6 % p.a. (yrs 1–3), +3.1 % p.a. (yrs 4–6), market-review cap 12 % | AEON sub-lets to OldTown, BananaBro, Adidas, Sushi Zanmai, etc. | 21.4 % of portfolio GRI |

| Paradigm Mall PJ | Lotus’s, GSC, H&M, Marks & Spencer, Fitness First, etc. | Head-leases staggered to 2111 | 273 tenants | 19.5 % of GRI |

| Paradigm Mall JB | Parkson, HomePro, GSC, Village Grocer, Harvey Norman, etc. | Head-leases expiring in 2030s–2040s | 449 tenants | 17.9 % of GRI |

Total tenants across the portfolio: 723, with no single tenant (other than AEON at BTSC) contributing more than 5 % of total GRI.

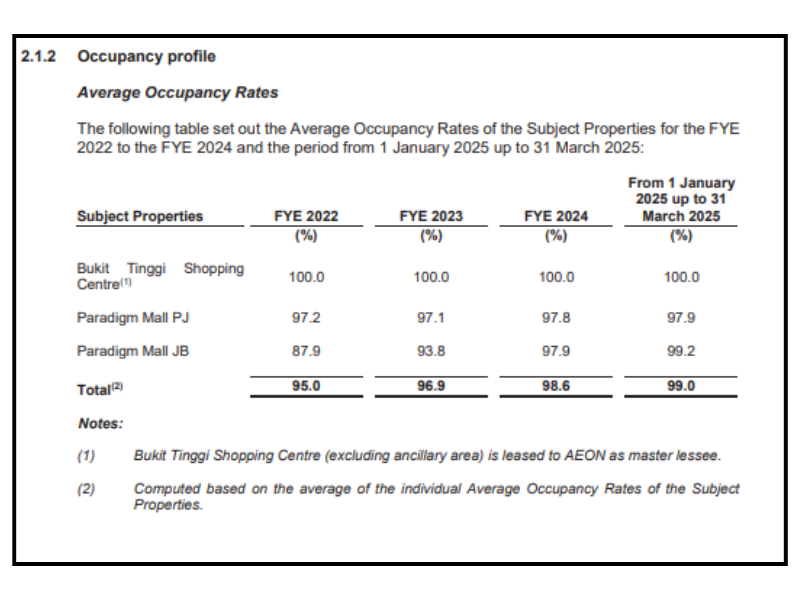

3. Occupancy & WALE Profiles

- Occupancy: Climbed from ~95 % in 2022 to ≈ 99 % by March 2025.

- Weighted Average Lease Expiry (WALE) by NLA:

- Paradigm Mall PJ: 1.54 years

- Paradigm Mall JB: 1.56 years

- BTSC: effectively 4.5 years via AEON master lease .

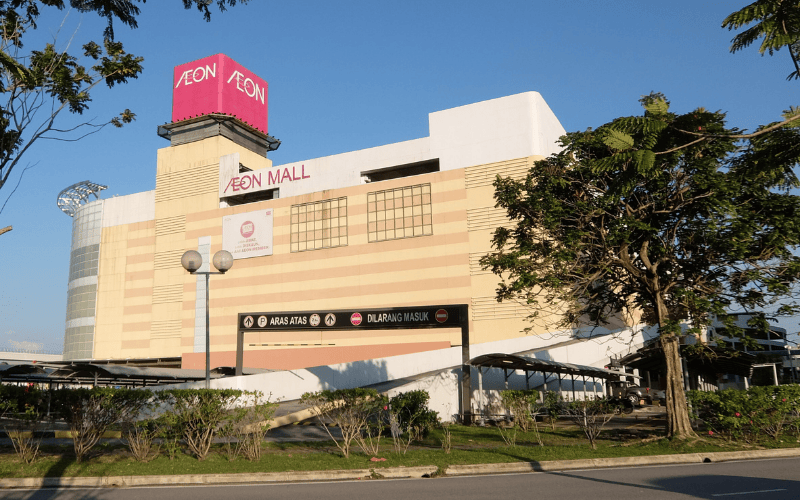

Photo from online

- Lease Bunching: ~55 % of PM JB’s NLA expires in 2026, a renewal risk to monitor.

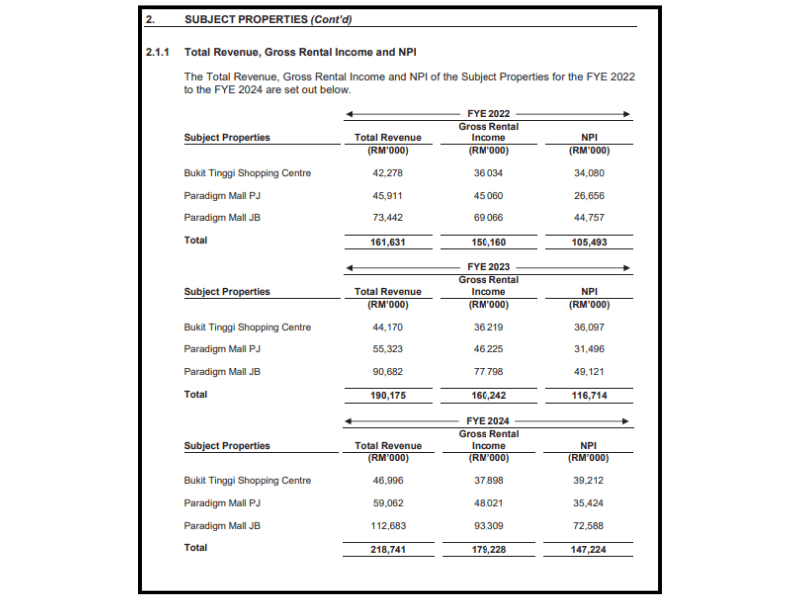

4. Historical Financial Performance

Photo from Wikipedia

| Year | Revenue (RM m) | Net Property Income (NPI, RM m) | Occupancy |

|---|---|---|---|

| 2022 | 161.6 | 105.5 | 95 % |

| 2023 | 190.2 | 116.7 | 96.9 % |

| 2024 | 218.7 | 147.2 | 98.6 % |

2024 revenue mix: 83 % rental; 11 % carpark; 6 % advertising & other.

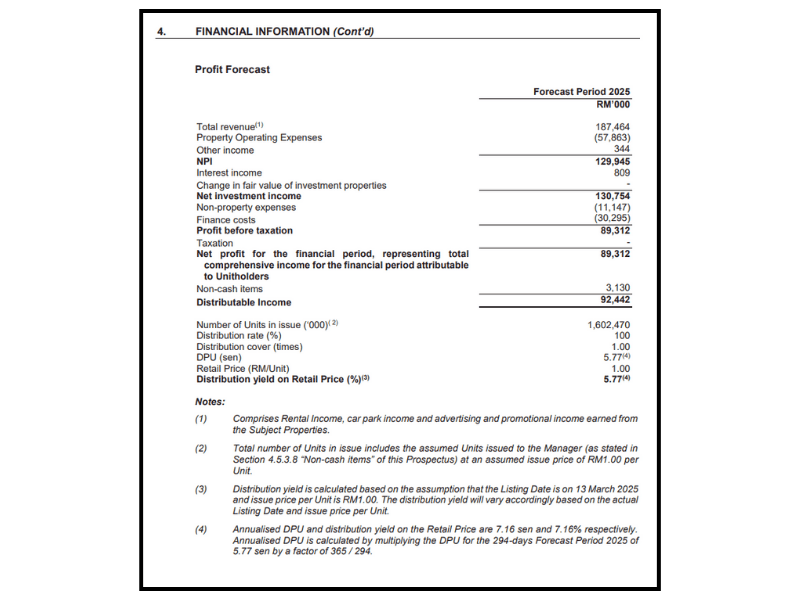

5. 2025 Forecast & Distribution Yield

- Period: 13 Mar–31 Dec 2025 (294 days)

- Forecast Distributable Income: RM 92.44 million

- Distribution Per Unit (DPU): 5.77 sen → annualised 7.16 sen, or 7.16 % yield at IPO price .

6. Distribution Policy

Paradigm REIT will distribute ≥ 90 % of distributable income semi-annually (1 Jan–30 Jun & 1 Jul–31 Dec). First payouts expected within two months after 31 Dec 2025.

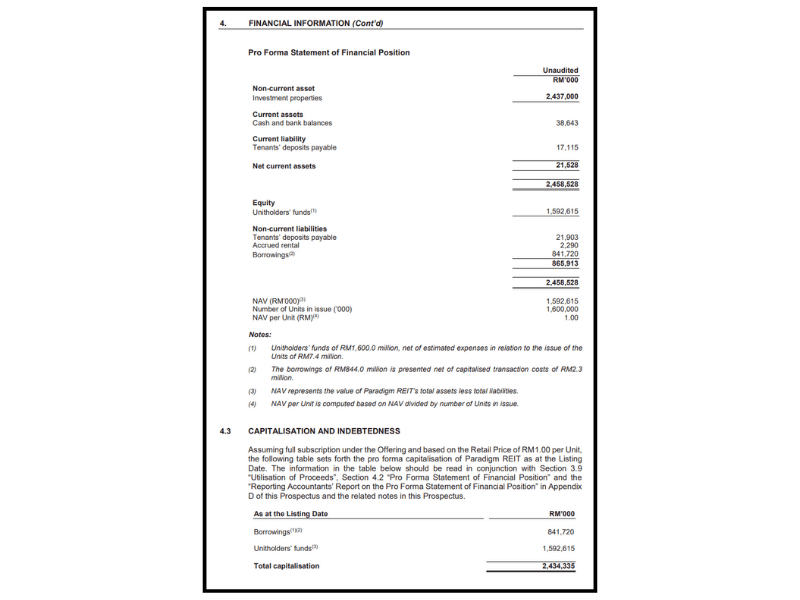

7. Balance Sheet & Debt Headroom

- Borrowings: RM 841.7 million via secured MTNs; gearing at 34 % of total assets (regulatory cap 50 %).

- MTN Programme: RM 5 billion ceiling, providing ample dry powder for acquisitions.

- Indicative Coupon: 4.44 % p.a.

8. Sponsor Alignment & Growth Pipeline

- Sponsor: WCT Holdings retains 65 % of units and owns 80 % of the Manager.

- ROFR: Right of first refusal on WCT’s future retail and hospitality assets (e.g., Hyatt Place JB, gateway@klia2) .

- Manager Fees:

- Base ≤ 1 % of total assets (0.3 % forecast for 2025)

- Performance ≤ 5 % of NPI (3 % forecast)

- Payable in cash and/or units.

9. Capital Expenditure & ESG Initiatives

- FY 2025 Cap-ex: None major; 2024 refurbishments completed by vendors pre-IPO.

- ESG Upgrades: Solar-PV systems, LED façade screens, HVAC enhancements at BTSC & PM JB to reduce utilities costs and diversify income.

10. Key Risks

- Lease Expiry Bunching – 55 % of PM JB NLA renews in 2026.

- Tenant Concentration – AEON accounts for 21.4 % of portfolio GRI.

- Interest-Rate Volatility – refinancing risk on MTNs.

- Retail Cyclicality & competitive mall landscape.

(See Prospectus §5 for comprehensive risk disclosures) .

Bottom Line:

Paradigm REIT lists with robust occupancy, diverse tenant mix, conservative gearing, and a visible pipeline for growth—offering a 7 %+ forward yield with semi-annual cash flows. Understanding GRI, NLA, and WALE will help you gauge its income predictability and upside potential before you subscribe.

Decoding Key Metrics for Readers

- Gross Rental Income (GRI)

- The sum of all rents collected before expenses.

- Use GRI to assess top-line strength and tenant contribution; a high concentration (top 10 tenants) signals dependency risk.

- Net Lettable Area (NLA)

- The leasable floor area excluding common areas.

- NLA underpins occupancy and WALE calculations; larger NLA at high occupancy translates to stronger absolute cash flows.

- Weighted Average Lease Expiry (WALE)

- The average remaining lease term, weighted by NLA or by rental value.

- Longer WALE = income stability; shorter WALE = potential for rental reversion.

By tracking how GRI evolves, how much NLA is occupied, and when leases roll over, investors gain insight into income resilience, growth potential, and renewal risk.

Looking for other’s blog: Stooper’s Business Talk

MYR 1 →

MYR 1 → USD: 0.2358

USD: 0.2358  SGD: 0.3036

SGD: 0.3036  EUR: 0.2083

EUR: 0.2083  THB: 7.6927

THB: 7.6927  KRW: 323.1171

KRW: 323.1171  CNY: 1.6972

CNY: 1.6972  JPY: 33.6755

JPY: 33.6755